France – VAT fiscal representative : VAT registration and management of VAT returns in France

France – VAT fiscal representative : VAT registration and management of VAT returns in France

Who needs VAT fiscal representation in France? Who should be appointed to manage VAT registration and handle the filing of returns? Why consult a VAT specialist? Discover our blog on the subject.

Obligation to appoint a VAT fiscal representatrive in France (art. 289 A CGI)

When a company established outside the European Union (“EU”) develops its business in the French market, it may be liable for French VAT and/or may need to fulfil VAT reporting obligations in France.

Should it be the case, it is mandatory to appoint a VAT taxable company, established in France, as a VAT fiscal representative to be entitled to register for French VAT.

This is particularly necessary when a non-European company:

– Sells and delivers goods from its country to French customers under the DDP (Delivery Duty Paid) Incoterm

– Stores goods in France for further distribution to the European market

– Carries out intracommunity deliveries or exports deliveries from France

– Carries out taxable importations in France

– Carries out intracommunity acquisitions of goods delivered in France

– Ships goods for processing in France before selling then and delivering them directly from France to European or non-European customers

– Buys and resells goods that remain on French territory (depending on the VAT status of the client).

– Delivers goods with installation or assembly in France (depending on the VAT status of the client).

– Provides services that are territorially taxable in France by application of a particular rule (depending on the VAT status of the client).

On the contrary, companies established in the European Union, in certain countries listed here, or companies carrying out transactions under VAT suspension according to Article 277 A I of the French General Tax Code, are exempt from the obligation to appoint a fiscal representative in France (Example: Delivery of goods under a fiscal suspension regime, or deliveries of goods under inward processing relief).

Who can act as a VAT fiscal representative in France?

In theory, any VAT-registered entity in France known to the tax authorities can act as a fiscal representative of the Art. 289 A CGI, provided it meets certain conditions to be accredited by his tax office.

In practice, this could be:

– A French subsidiary of the non-European company

– A French client company

– A licensed customs representative

– A trading company or a manufacturer

– Banking institution carrying out taxable transactions (rarely, if ever, encountered in practice)

– A company specialized in VAT fiscal representation.

Why choose a company specialized in VAT fiscal representation?

Entrusting your fiscal representation to a company specialized in VAT fiscal representation ensures:

The assurance that your declarations will be properly managed

The core business of companies specialized in VAT fiscal representation is to properly manage the filing of compliant declarations.

They are responsible for:

– Ensuring compliance with VAT obligations related to all operations carried out by the non EU entity

– Payment of the VAT due on operations for which they must the reporting obligations.

The assurance to stay up to date with the latest regulatory developments

Since 2020, at least five major VAT reforms incurred in France, that have significantly impacted businesses. These include the 2020 “quick fixes” reform, the e-commerce VAT reform and BREXIT in 2021, the generalization of postponed accounting method for import VAT, the removal of the DEB, and the creation of the statistical survey (EMEBI) and VAT recapitulative statement in 2022.

Your fiscal representative closely monitors French and European regulatory developments to anticipate changes in your business.

The assurance to apply the correct VAT rate, exemptions, or simplification mechanisms

France has four VAT rates in mainland France and specific rates for the DOM/TOM, as well as numerous exemptions for specific services and deliveries , and as many different simplification regimes.

Your fiscal representative is fully aware of the formal requirements your company must meet to comply with VAT regulations and avoid any potential risks.

Benefit of a constant monitoring of new additional reporting obligations.

Depending on the operations you perform, you may need to submit statistical surveys EMEBI and VAT recapitulative statements in France, as well as declare certain operations through the one-stop-shop portals OSS-EU, OSS-NEU, and/or IOSS.

In the coming years, new obligations will also emerge: e-invoicing (electronic invoicing) and e-reporting (transaction data transmission).

Your fiscal representative detects and informs you of any new reporting obligations you may have.

The assurance torecover VAT on purchases in full compliance

Deducting VAT on a VAT return requires compliance with formal and substantive conditions. Your fiscal representative ensures that the VAT on your purchases is deductible in order to mitigate any risk of challenge in case of a tax audit.

“For VAT SOLUTIONS, fiscal representation goes far beyond the simple filing of VAT returns: it’s your guarantee of compliance with your VAT obligations. ”

How does VAT SOLUTIONS handle VAT Registration?

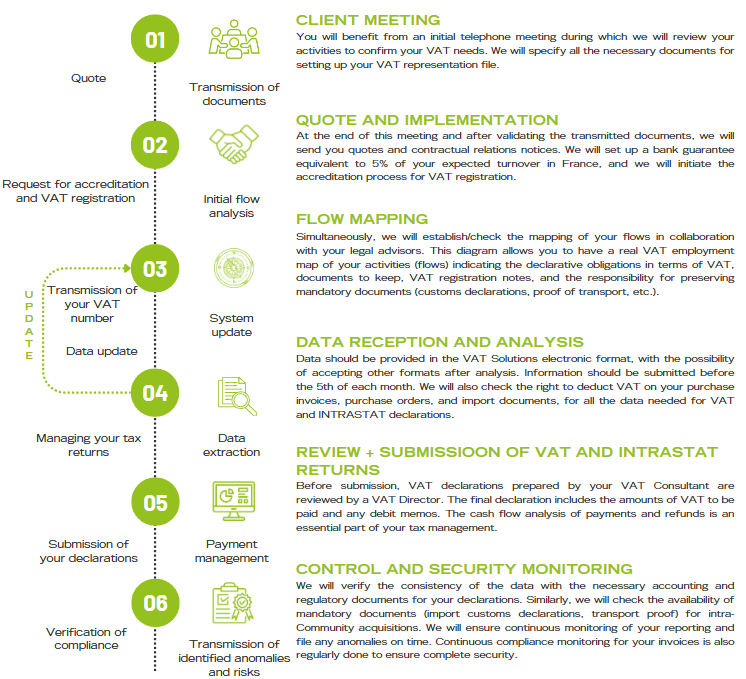

To support the development of your business in France, VAT SOLUTIONS has established a secure end-to-end process. We plan a first phase of discovery, analysis, and VAT compliance, a second phase of setting up VAT fiscal representation, and finally, a third phase of continuous monitoring and securing your VAT compliance.

Discover the details of our VAT registration process in France below:

Discover our services

VAT Solutions offers a range of services to assist you with your VAT-related challenges in France and internationally:

– Diagnostic of your VAT organization, your flows, and the methods for preserving proof of exempt operations, as well as assessing the impact of new VAT rules;

– Confirmation of the VAT treatment of your flows;

– Coaching/training;

– Management of VAT obligations in Luxembourg and abroad: assistance, preparation, and submission of VAT identification requests and VAT returns.

Contact us

Phone number: + 33 6 12 37 32 22

Email: info.fr@vat-solutions.com

For more content, check out our LinkedIn page here.

By agreeing, we’ll assume that you are satisfied with our use of cookies on your device.

If you continue navigating, we’ll assume that you are happy to receive all cookies from our website.

Otherwise, you can change your settings at any time.

En acceptant, nous supposerons que vous êtes satisfait de notre utilisation des cookies.

Si vous continuez à naviguer, nous supposerons que vous acceptez de recevoir l’ensemble des cookies de notre site web.

Sinon, vous pouvez modifier vos paramètres à tout moment.