France – Intra-Community supply exempt from VAT and proof of transport

France – Intra-Community supply exempt from VAT and proof of transport

Find out how to secure the VAT regime applied to your intra-community supplies with transport evidence.

What is an intra-community supply of goods?

An intra-community supply refers to the delivery of goods dispatched or transported by the seller, the buyer, or on their behalf, to another member state of the European Union, destined for a taxable person or a non-taxable legal entity acting as such.

Stock transfers are considered as intra-community supplies.

For intra-community supplies and equivalent supplies to be exempt from French VAT, four conditions must be cumulatively met:

– The goods must leave French territory, destined for another member state (pay attention to transport evidence!)

– The goods are dispatched or transported by the seller, the buyer, or on their behalf (be cautious with chain sales!)

– The buyer must have a valid VAT number in the European Union, issued by a member state other than France (make sure to obtain and verify it before the sale!)

– The seller must report the sale in a VAT recapitulative statement (beware of late or incomplete filings!)

Find out how to secure the VAT regime applied to your intra-community supplies with transport evidence.

Securing your intra-community supplies with transport evidence

The European rebuttable presumptions

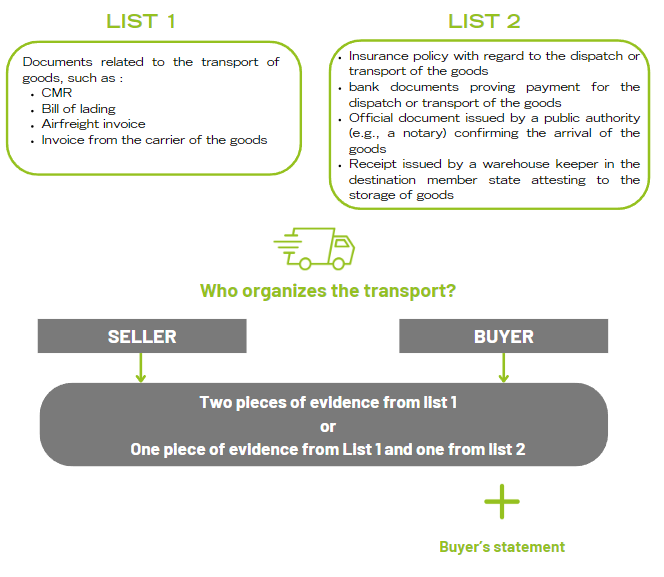

Article 45a of Regulation 282/2011 (introduced by Regulation 2018/1912 of December 4, 2018) established two presumptions: the first when the transport is arranged by the seller, and the second when it is arranged by the buyer.

If the conditions are met, the goods are presumed to have been transported outside of France to another member state. These presumptions are rebuttable, meaning that the tax authorities can challenge this evidence.

To benefit from these presumptions, the seller must possess evidence from the two lists below and, in certain cases, have a statement from the buyer.

First presumption: if the seller organizes the transport

The seller must retain:

– Either two pieces of evidence from list 1

– Or one piece of evidence from list 1 and one piece of evidence from list 2

2nd presumption: if the customer arranges the transportation

The seller must retain:

– Either two pieces of evidence from list 1 and a written certificate of receipt of the goods by the buyer

– Or one piece of evidence from list 1, one piece of evidence from list 2, and a written certificate of receipt of the goods by the buyer

The certificate, in paper or electronic format, must be provided no later than the tenth day following delivery and must include the following details:

– The destination Member State – The date of issue, the name, and address of the buyer – The quantity and nature of the goods – The date and place of arrival of the goods – The identification of the person accepting the goods on behalf of the buyer

If the seller does not wish to, or is unable to, benefit from the rebuttable presumptions, they may attempt to prove the dispatch of the goods by any means.

Proof by any means

The seller must gather as many supporting documents as possible from the following list to justify the transport of goods to another Member State of the European Union:

– Transport document (road consignment note under the Convention on the Contract for the International Carriage of Goods by Road (CMR), air waybill, maritime or river bill of lading, etc.)

– Invoice from the carrier

– Insurance contract related to the international transport of goods

– Contract concluded with the buyer

– Commercial correspondence

– Purchase order issued by the buyer indicating that the goods are to be shipped or transported to another Member State

– Delivery note

– Pickup note

– Written confirmation from the buyer of the receipt of the goods in another Member State

– Duplicate of the seller’s invoice bearing the buyer’s stamp

– Proof of payment from a foreign bank.

Please note that this list is not exhaustive, and the tax inspector will assess the overall value of the provided justifications on a case-by-case basis.

Discover our services

VAT Solutions offers a range of services to assist you with your VAT-related challenges in France and internationally:

– Diagnostic of your VAT organization, your flows, and the methods for preserving proof of exempt operations, as well as assessing the impact of new VAT rules;

– Confirmation of the VAT treatment of your flows;

– Coaching/training;

– Management of VAT obligations in Luxembourg and abroad: assistance, preparation, and submission of VAT identification requests and VAT returns.

Contact us

Phone number: + 33 6 12 37 32 22

Email: info.fr@vat-solutions.com

For more content, check out our LinkedIn page here.

By agreeing, we’ll assume that you are satisfied with our use of cookies on your device.

If you continue navigating, we’ll assume that you are happy to receive all cookies from our website.

Otherwise, you can change your settings at any time.

En acceptant, nous supposerons que vous êtes satisfait de notre utilisation des cookies.

Si vous continuez à naviguer, nous supposerons que vous acceptez de recevoir l’ensemble des cookies de notre site web.

Sinon, vous pouvez modifier vos paramètres à tout moment.