- Home

- Luxembourg

- Quick fixes 2020 : transposition of the VAT reform into Luxembourg

Quick fixes 2020 : transposition of the VAT reform into Luxembourg

Quick fixes 2020 : transposition of the VAT reform into Luxembourg

Quick fixes and VAT: Intra-Community deliveries, consignment contracts, chain sales, discover the implementation of the reform in Luxembourg.

Transposition of Quick Fixes into Luxembourg VAT Law

The bill of law n°7446 was adopted on 4th December 2019 and was published in the Official Journal on 6 th December 2019, together with the Grand-Ducal Regulation of the same date. This law implements into the Luxembourg VAT law, hereinafter « LVATL », the new rules deriving from the EU Directive 2018/1910 of 4th December 2018, so-called “Quick Fixes”, which will enter into force on 1st January 2020. On the same date, the other provisions « Quick fixes », resulting from the EU Implementing Regulation 2018/1912 amending the Regulation 282/2011, will also come into force ; they were already commented on 17th May 2019 by a circular letter from the Luxembourg VAT

Authorities (Administration de l’Enregistrement, des domaines et de la TVA « AEDT »).

The European Commission published explanatory notes about Quick Fixes on 20th December. These explanatory notes are not binding, however they offer a useful practical vision of these new rules.

As a reminder, “Quick Fixes” are meeting very specific VAT issues concerning intra-community transactions involving goods, to which it was necessary to apply immediate adjustments, before the adoption of a definitive VAT system that will be announced in the longer term. They are made up of 4 measures, detailed hereafter (1 to 4). The law adopted on 4th December introduces also other amendments to LVATL (5) :

Regime of call off stocks : new simplification for cross-border stocks

The regime of call of stocks- or consignment stock – covers the case where the supplier transfers goods of its own from a Member State (MS) to another, in order to stock them for onward delivery to a local customer. As goods remain the property of the supplier until they are sold, the supplier must fulfil his VAT obligations in the country of the stock (VAT registration, filing of VAT returns).

Some Member States implemented simplification measures, but the lack of harmonisation as well as difficulties met by the operators, urged the European legislator to harmonise the rules, that are now applicable in the same way in all Member States. These rules can be found in Luxembourg in Article 12bis of LVATL.

As a consequence, an operator transferring its goods to a foreign stock in the context of a call off or consignment stock as from 1st January 2020 will no longer have to register to VAT in the Member State of destination of goods, and its sale will be considered as an exempt intra-community sale. This implies the fulfilment of some obligations, particularly concerning the acquirer (who has to be known at the time of the transfer), concerning the sale (which must be local), concerning the deadline in which the sale has to take place (12 months after the arrival of goods in the stock), concerning the keeping of detailed records by the vendor and by the acquirer) and concerning the submission of additional information in the EC sales list (modifications of article 64bis).

Exemption of intra-community supplies: the end of the tolerance period for the filing of the EC sales lists ?

Intra-community supplies of goods are currently VAT-exempt, notably under the conditions that the acquirer is a VAT taxable person, and that the goods are actually delivered to another Member State.

As from 1st January 2020, two additional formal conditions will be added into the LVATL (new article 43.1.d. of LVATL) :

– The acquirer must have communicated to the vendor his VAT registration number, issued by another Member State ;

– The vendor must have filed, within the legal period, an accurate EC sales list. Failing, the vendor can duly justify its failure. It is up to the AEDT to appreciate and accept the justification.

In practice, these conditions were already required in Luxembourg. However, we draw the attention of the taxable persons to the risks that are now linked to the use of the additional tolerance period of 1 month, for the filing of EC sales lists ! This can indeed jeopardize the application of the VAT exemption on the sale.

Evidences of the transport for intra-community deliveries : one evidence is not enough !

Currently, Luxembourg taxable persons can rely on various documents, commented by the circular letter n° 679 of 1st July 1999, to prove by means of different evidences, that goods were dispatched or transported from Luxembourg to another Member State. In practice, the transport document issued by the carrier is usually sufficient.

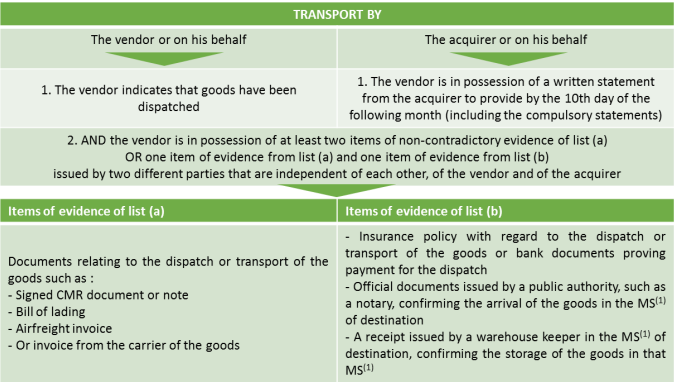

The new article 45bis of Implementing Regulation (EU) n°282/2011 aligns the evidences to provide in order to justify the transport of the goods outside a Member State for the purposes of the VAT exemption of intra-community supplies of goods : as from 1st January 2020, the vendor will have to be in possession of at least 2 items of non-contradictory evidence issued by two different parties that are independent of each other, from the vendor and the acquirer, in order to benefit from the rebuttable presumption that goods left the Luxembourg territory. If the sale takes place under the « departure » conditions (the acquirer organises the transport outside Luxembourg), the vendor should also obtain a statement signed by the acquirer.

The new requirements are summarised in the table hereafter :

It should be noted that evidences for the justification of VAT exemption on exports remain the same and that the comments on the circular letter n° 679 of 1st July 1999 are still relevant.

Chain transactions : to which sale shall the transport be ascribed ?

A chain transaction presupposes the existence of several successive sales of same goods, implying a single transport from the first supplier based in a Member State, to the last acquirer in the chain, based in another Member Sate. In such a context, only one sale, the one to which the transport or dispatch shall be ascribed to, can benefit of the VAT exemption for intra-community supply.

Due to the lack of harmonisation between the Member States, the determination of the sale to which the transport of dispatch should be ascribed, and that would be exempt, could be difficult.

The new article 14.2bis. of LVATL introduces a presumption that applies if the transport is organised by the intermediate operator or on its behalf : the transport or dispatch should, in principle, be ascribed to the supply of goods made by the initial supplier to the intermediate operator. However, if the intermediate operator communicates a VAT registration number issued by the Member State of departure of the goods, the dispatch or transportshould then be ascribed to the supply of goods made by the intermediate operator to the final acquirer. On the other hand, if the transport is organised by the initial vendor, it is necessarily ascribed to its sale, whereas, if the transport is organised by the final acquirer, it is ascribed to the sale in its favour.

Other amendments

The law of 4th December 2019 provides other amendments to LVATL:

– Extension of the local reverse charge regime to the supply of gas and electricity certificates (new article 61.3.b. LVATL) ;

– Some editorial corrections for references within article 61 ;

– Obligation for taxable persons under scheme for small entrepreneurs (“franchise”), to file an annual tax return within two months after the cessation of their activities (article 64.5bis ; 3rd subparagraph LVATL).

Discover our services

VAT SOLUTIONS offers various services to support you with your VAT requirements in Luxembourg and internationally:

– Diagnosis of your VAT organisation, your activities, and procedures for keeping evidences of exempt operations ; measure of the impact of the new VAT rules;

– Confirmation of the VAT treatment of your activities;

– Coaching/trainings;

– Management of VAT obligations in Luxembourg and abroad : assistance, preparation and filing of the VAT registration form and of VAT returns.

Contact us

Phone number: +352 26 945 944

Mail : info@vat-solutions.com

And for more content, check out our linkedin page here.

By agreeing, we’ll assume that you are satisfied with our use of cookies on your device.

If you continue navigating, we’ll assume that you are happy to receive all cookies from our website.

Otherwise, you can change your settings at any time.

En acceptant, nous supposerons que vous êtes satisfait de notre utilisation des cookies.

Si vous continuez à naviguer, nous supposerons que vous acceptez de recevoir l’ensemble des cookies de notre site web.

Sinon, vous pouvez modifier vos paramètres à tout moment.