- Home

- Luxembourg

- VAT Guide in Luxembourg : Which VAT should I pay on company vehicles and in which Country?

VAT Guide in Luxembourg : Which VAT should I pay on company vehicles and in which Country?

Which VAT should I pay on company vehicles and in which Country?

Provision of vehicles to Luxembourg and cross-norder employees: discover the taxation rules, how to analyze your situation, and the VAT calculation methods.

Luxembourg Context

Providing company vehicles is a well-established practice in Luxembourg’s salary policies, including for the many cross-border employees residing in Germany, Belgium, and France.

For a long time, Luxembourg employers’ practice was to pay VAT for the private use of cars in Luxembourg. However, the QM ruling has disrupted these practices.

Impact of the QM Ruling

The QM ruling of January 20, 2021 (Case C-288/19) by the Court of Justice of the European Union clarified that the provision of a company vehicle could constitute a long-term lease of a means of transport, taxable at the employee’s place of residence, provided the following conditions are met:

– The service is provided for consideration.

– The employee has the permanent right to use the car for private purposes and to exclude others from its use, for a period exceeding 30 days.

To determine if these conditions are met, you need to analyze:

– The employment contract.

– The car policy.

– The conditions of vehicle use.

Consequences for Employers When Conditions Are Met

Place of Taxation and Reporting Procedures

When the provision of a company vehicle meets the conditions for a long-term lease of means of transport, VAT is payable at the employee’s place of residence.

The employer pays the VAT:

- Via the Luxembourg VAT return when the employee resides in Luxembourg.

- Or via the VAT one-stop-shop “OSS EU” or local VAT registration in the employee’s country of residence if the employee is a cross-border worker.

If any of the conditions are not met, it is considered a service taxable in Luxembourg, regardless of the employee’s place of residence. The VAT is then paid by the employer through the Luxembourg VAT return.

Caution: Germany considers that the first condition “service provided for consideration” is always met when a vehicle is provided to an employee. This can, in some cases, lead to double taxation in the employer’s country (LU) and the employee’s country (DE).

VAT Calculation Method for Company Vehicles

Once the place of taxation is determined, the taxable base on which VAT applies must be determined.

- For Vehicles Provided to Employees Residing in Germany

VAT is due on the normal value if it exceeds the contractual value that compensates for the provision of the vehicle.

The normal value can be calculated in two ways:

– Based on costs, subtracting actual professional use (logbook required, but very restrictive).

– Or on a flat-rate basis: VAT-inclusive car value x 1% + VAT-inclusive car value x 0.03% x number of km from home to work = VAT-inclusive value to be declared.

- For Vehicles Provided to Employees Residing in Belgium

VAT is due on the normal value if it exceeds the contractual value that compensates for the provision of the vehicle.

The normal value is determined based on costs, subtracting 35% for professional use.

- For Vehicles Provided to Employees Residing in Luxembourg

VAT is due on the normal value if it exceeds the contractual value that compensates for the provision of the vehicle.

The normal value is determined based on costs, subtracting actual professional use. This requires strict maintenance of a logbook.

- For Vehicles Provided to Employees Residing in France

The concept of normal value is not introduced in France.

VAT is therefore due, subject to verification, on the contractual value that compensates for the provision of vehicles.

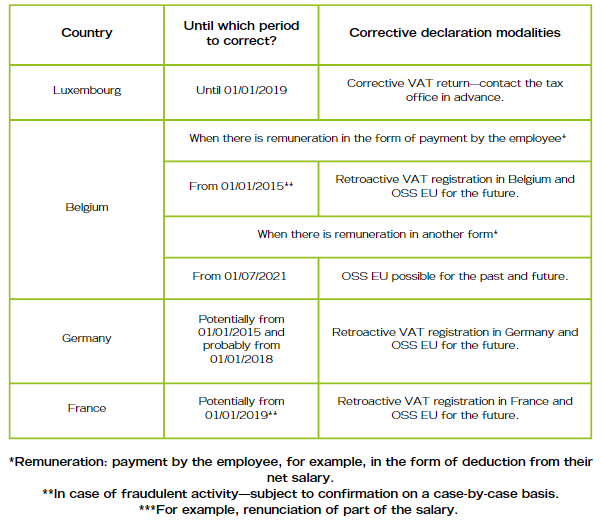

Rectification of Previous Periods

It is essential to then analyze past periods to identify risks and the need for adjustments according to the following procedures.

This is the case if VAT was wrongly paid in Luxembourg for a similar service if the provision of the car is qualified as a long-term lease taxable abroad.

Corrective returns must be filed in Luxembourg to recover any VAT possibly paid in error.

A retroactive VAT registration in the employees’ countries of residence may be necessary to pay the local VAT.

Attention: The rectification of past periods should not be a deterrent; the priority is to ensure compliance for the future.

Lost in these regulations? Discover our infographic that guides you step by step for VAT compliance with complete peace of mind.

Discover our services

VAT SOLUTIONS offers various services to support you with your VAT requirements in Luxembourg and internationally:

– Diagnosis of your VAT organisation, your activities, and procedures for keeping evidences of exempt operations ; measure of the impact of the new VAT rules;

– Confirmation of the VAT treatment of your activities;

– Coaching/trainings;

– Management of VAT obligations in Luxembourg and abroad : assistance, preparation and filing of the VAT registration form and of VAT returns.

Contact us

Phone number: +352 26 945 944

Mail : info@vat-solutions.com

And for more content, check out our linkedin page here.

By agreeing, we’ll assume that you are satisfied with our use of cookies on your device.

If you continue navigating, we’ll assume that you are happy to receive all cookies from our website.

Otherwise, you can change your settings at any time.

En acceptant, nous supposerons que vous êtes satisfait de notre utilisation des cookies.

Si vous continuez à naviguer, nous supposerons que vous acceptez de recevoir l’ensemble des cookies de notre site web.

Sinon, vous pouvez modifier vos paramètres à tout moment.